Facebook has over 2.23 billion active users monthly.

A platform of such magnitude offers an incredible opportunity for reaching your target market.

Because Facebook's algorithm is ever-changing, your marketing techniques may have to pivot over time, but these tips will get you started.

Creating the business page

Of course, the first step to having a successful Facebook business page is to create the page.

When creating the page, you want to ensure it is a business page and not a personal page. Creating a personal page for your business puts you at a disadvantage since you would miss out on tools to help with content creation, analytics, and paid promotional opportunities.

Therefore, be sure you choose a business page to take advantage of these great tools and more.

You can do so by visiting https://www.facebook.com/pages/creation or choosing to create a new page in the Facebook menu.

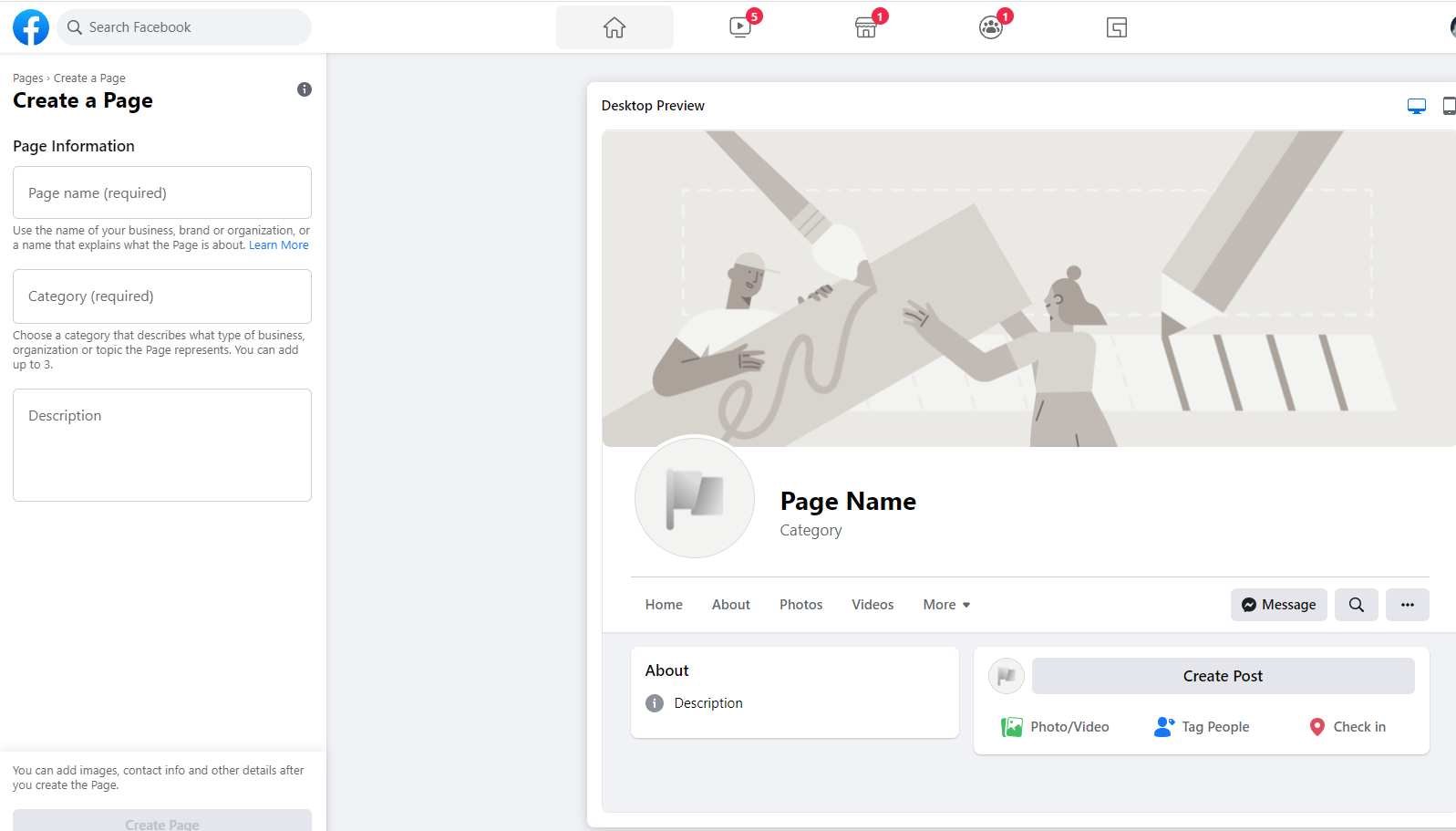

There you will be asked for additional information about your page. You will be prompted to input your business name, business category, and a description of the business, as shown below.

Once filled out, the greyed-out “Create Page” button will turn blue, and you will select it to create your page.

From there, input a profile image and a cover image. When it comes to Facebook, your cover photo is the largest element of your brand identity.

It should be something eye-catching, engaging, and exciting to keep users on your page.

Your profile image should incorporate your logo in some way. It is essential to maintaining brand recognition across various platforms. It will help users to build a connection and identify your brand.

Once you pick out the perfect photos, consider adding a call to action (CTA) button to your page.

This button appears under your cover photo and is viewable to anyone who visits your page.

It is customizable to reflect the desired action. You can prompt visitors to watch a video, sign-up, or book a call.

From there, it is as simple as placing the proper URL or piece of content to make your button operational.

The CTA button is a great way to drive traffic to a location of your choosing without any promotional work on your end.

How to attract fans to your page

Rather than creating your page and immediately inviting people to like it, take a moment to strategize.

Content is key to attracting visitors to a page, so sprinkle some into it to make it informative, inviting, and engaging.

Providing content upfront gives visitors enough information about your page to decide whether they are interested in it.

Share a few photos or videos about your business. You can share service and product lists, menus, or pictures of your office building. Before inviting anyone, you should have three to five posts on your page.

Once your posts are live, you can try these tips to attract fans:

- Invite your Facebook friends: tell your friends about your new Facebook business page. After you invite them, they will receive a notification inviting them to visit your page.

- Invite your coworkers: Most people in your business are already familiar with your page, so they are more likely to like it. You can take it a step further and have them invite their friends to the page.

- Promote your page on your website: Facebook offers buttons and widgets to add to your website and makes it easy for people to visit, even from another platform.

- Promote your page in company email signatures: This is an easy way to promote your page in a visible location. Simply planting your business page link in all company email signatures will ensure those connected to your company in any way receive a direct invitation to visit.

What to post and when to post

The variety of content you can share on your Facebook business page includes photos, videos, stories, text updates, and direct links.

Experiment with post types to see what is most popular and resonates with your audience.

Videos tend to be the most popular and receive twice as much engagement as other posts.

If you do post videos, ensure they are optimized for mobile use, as most users will be viewing their content on the go.

Regarding when and how much to post, the algorithm makes it difficult to give a definitive answer. The best way to navigate it is to experiment with your audience.

If your posts have not performed well after a week, review your analytics and adjust your posting schedule or number of posts appropriately.

Regardless of how much you post, ensure every post is unique and fresh – no one wants recycled content.

Facebook Insights will be available to you at the top of the Facebook menu to view your page analytics, including what time of day your fans are most active. You can then tailor your posting schedule to accommodate your audience.

As your fans on your page grow, you will get more precise analytics of when the best time to post is, but a Facebook business page is a great way to reach this audience online.

After your page is ready for success, you can funnel energy towards Facebook paid ads and organic content to boost fans and engagement.

From there, keep nurturing your audience and posting relevant, fresh content to maintain long-term success with your Facebook business page.

Want to read our featured articles?

Build vs Buy: What is a Better Approach Towards Starting an E-Commerce Business?

When Does It Make Sense to Hire a Financial Advisor?

Do You Need a Creative Agency for Small Business?

Like our content and want even more useful and powerful information to grow your business and advance in life faster?

Consider subscribing to “Prosperity Pulse”, our Premium Monthly Premium Coaching, Prosperity Pulse where you can find the latest strategies, information, and resources on business development, entrepreneurship, marketing, finance, real estate, as well as Personal and Business credit.

It’s also where we share exclusive 0% APR Business Credit Card offers that just hit the market and the most impactful industry trends. You can also expect to hear from our internal industry specialist team at Fund&Grow for instantly applicable tips and tools to help you experience personal growth and business prosperity.

About Prosperity Pulse:

Whether you just launched a start-up or you’re already a seasoned entrepreneur, Prosperity Pulse will provide actionable methods to improve your day-to-day business operations and achieve maximum sustainable growth.

In our Premium Coaching, you’ll read content-packed articles on credit & financial education, inspirational content-packed tips, resources from our industry experts, and tons of actionable content to save you precious energy, money, and time along your entrepreneurial journey.

Prosperity Pulse is the ultimate premium coaching that will connect you to the latest business and entrepreneurial trends in the marketplace so you can act on them before the competition.

Not only will you get a digital copy of the premium coaching, but we will mail you a physical print version each month. Click here to sign-up for Prosperity Pulse.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

have a question?

Our business experts are available to answer questions Monday - Friday from 9:00 a.m. - 6:00 p.m. EST

Call Us:

(800) 996-0270

Email Us:

service@fundandgrow.com

Watch our business credit webinar:

Obtain $250,000 Business Credit

Let's Stay Connected on Social Media!

For over 15 years, Fund&Grow has helped 30,000+ business owners get access to over 1.6 Billion dollars of business funding. We're on a mission to empower the small business owner by helping them tap into the smartest form of funding: Unsecured Business Credit – so that they can achieve their goals and dreams.

Contact

Information

"Fund&Grow was created to empower small business owners, but more importantly, to support entreprenuers in achieving their business and personal goals while they lead the way towards innovation." - Ari Page CEO of Fund&Grow

Ari Page and the Fund&Grow team help business owners obtain access to credit despite the ambiguous lending climate. Many people feel ripped off and scammed by the bank bailouts and wonder why they can't use the system to their advantage the way the big banks did. If you have good credit, the Fund&Grow program will get you the funds you need to grow your business.

Find 4,000+ 4.9-star average customer testimonials on the following platforms: SoTellUs, Trustpilot, Google, BBB, among others.

All credit is subject to lender approval based upon credit criteria. Up to $250,000 in business credit is for highly qualified clients over the term of the membership with multiple credit card batches and/or credit lines. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement. Fund&Grow is not a lender.

© 2025 Fund&Grow. All Rights Reserved.

Share

Share