The dynamic world of e-commerce thrives on constant change, and PayPal is no stranger to innovation. In an effort to "revolutionize commerce," PayPal recently announced a rollout of six new features during their first look video event.

These enhancements promise to bring numerous benefits, such as improved conversion rates, less cart abandonment, and more direct interaction between merchants and customers. Here's a comprehensive overview of what's coming to PayPal in 2024.

The 6 New PayPal Features

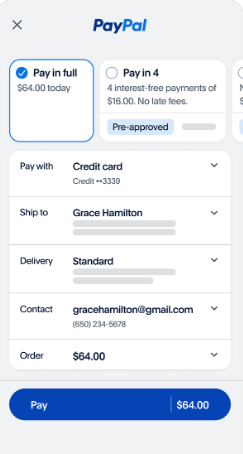

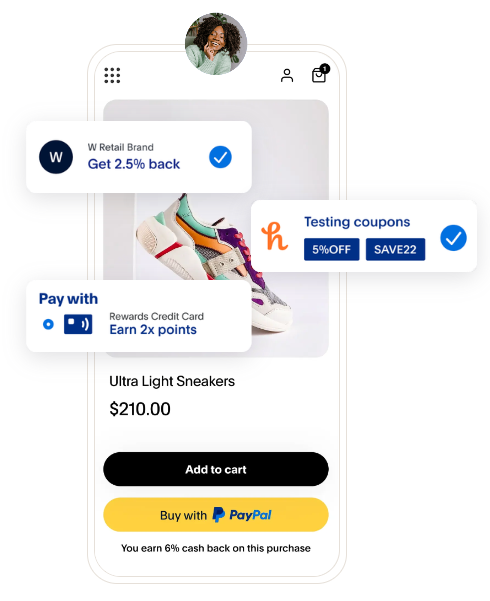

1. New and Improved PayPal Checkout

Ensuring a smooth and hassle-free checkout process is vital for driving sales, and PayPal has completely revamped theirs with this objective in mind. The new PayPal Checkout introduces biometric logins to speed up authentication and dropdown menus for a quick selection of payment methods, shipping information, and delivery options.

Source: PayPal

The purpose of this streamlined flow is to minimize hassle and decrease the time spent during a transaction, resulting in reduced abandoned carts and increased customer satisfaction.

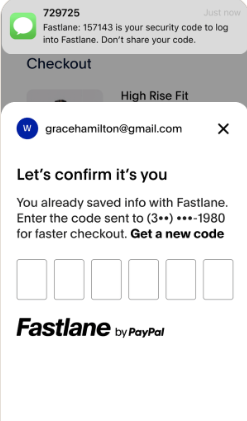

2. Fastlane by PayPal

For online shoppers, the hassle of creating accounts can deter them from completing a purchase. Recognizing this, PayPal is introducing Fastlane – a guest checkout feature enabling customers to bypass the tedious process of account creation and password memorization.

Source: PayPal

According to PayPal, Fastlane "can accelerate checkout speeds by nearly 40% compared to a traditional guest checkout."

By leveraging a seamless checkout process, Fastlane opens the door for sporadic shoppers to become recurring customers, enhancing the shopping experience for all users.

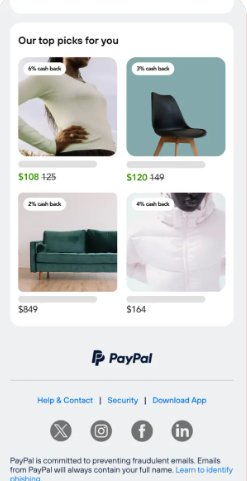

3. AI-powered Smart Receipts

Continuing their quest for innovation, PayPal's new Smart Receipts are AI-driven and tailor-made for each user.

Source: PayPal

Imagine receiving receipts that provide transaction details and offer personalized product recommendations and discounts relevant to your shopping patterns. This feature enriches the post-purchase experience and potentially increases customer loyalty by offering value beyond the transaction.

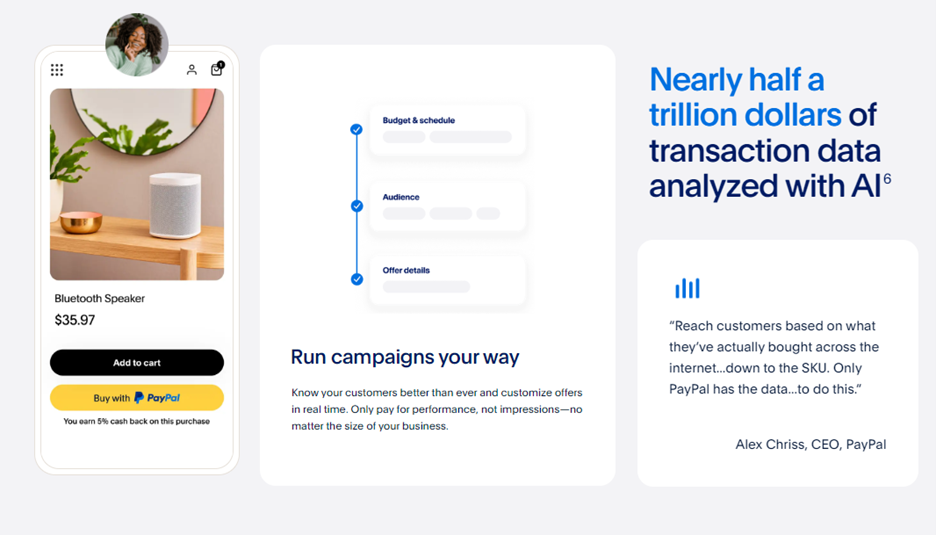

4. Advanced Offers Ads

In a move to redefine digital advertising, Advanced Offers Ads empowers merchants with a performance-based advertising platform where they only pay when customers engage with their ads.

Source: PayPal

This precision-targeted approach utilizes PayPal's extensive transaction data to deliver ads that resonate with individual users' preferences—turning browsing into buying.

5. PayPal Consumer App Redesign & CashPass

The freshly designed PayPal app aims to become an e-commerce destination in itself. With a personalized interface showcasing deals and unlimited cashback offers, alongside the unique CashPass feature processing these incentives, shopping is just a tap away.

Source: PayPal

Moreover, when shoppers move cash back earnings to a PayPal savings account, you will earn the current APY rate on your cash back, which is 4.30% APY as of posting.

Users get the benefit of an integrated marketplace and the convenience of centralized offers—enhancing the digital wallet to a shopping companion.

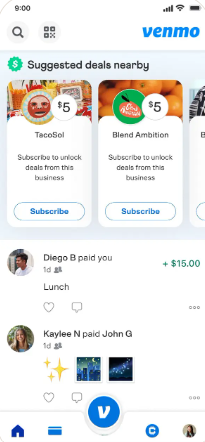

6. Enhanced Venmo Business Profiles

Not forgetting their social payments service, Venmo's Business Profiles have received a significant boost. Merchant profiles will now include additional promotional tools, subscription functionalities for eager customers, cashback offerings, as well as visibility enhancements like profile rankings.

Source: PayPal

As your business grows and makes more sales, you can earn profile badges and rank higher, attracting new customers and fostering trust with them. Additionally, your business could be featured on the Venmo feeds, which get shown to customers in your area.

Venmo's new profile features seek to strengthen the connection between businesses and consumers in today's social-centric shopping ecosystem.

The Impacts of PayPal's Innovations

These newly announced features denote PayPal's commitment to supporting small business growth while enriching the consumer experience. With nearly 400 million consumer accounts and 35 million merchant accounts, PayPal's market presence is already formidable. The effective deployment of these dynamic tools will likely solidify its dominance in the digital payments arena.

The synergy of these features can help small businesses adapt to the evolving demands of online commerce and keep pace with the competition. The critical advantage lies in understanding and leveraging these tools to gain a vital edge. By enabling features like Fastlane and Smart Receipts, businesses can expect to see an uptick in sales, whereas the power of Advanced Offers Ads might boost marketing effectiveness like never before.

Stay Ahead in 2024

The digital marketplace is heading towards a more integrated and user-focused future. PayPal's response with its new features is poised to make waves industry-wide, presenting entrepreneurs with a suite of tools essential for riding the crest of innovation.

As PayPal's improvements roll out throughout 2024, keep on the lookout for how these enhancements could transform your business tactics and customer engagement strategies.

Whether you're an entrepreneur starting a venture or an established business owner, these PayPal innovations represent keys to a realm of new possibilities in e-commerce. Ignoring them is not an option—embracing them, however, could mean the difference between surviving and thriving in the fast-paced world of online sales.

So gear up and get ready to welcome these exciting new features from PayPal; the future of e-commerce is here, and it's more accessible than ever.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

have a question?

Our business experts are available to answer questions Monday - Friday from 9:00 a.m. - 6:00 p.m. EST

Call Us:

(800) 996-0270

Email Us:

service@fundandgrow.com

Watch our business credit webinar:

Obtain $250,000 Business Credit

Let's Stay Connected on Social Media!

For over 15 years, Fund&Grow has helped 30,000+ business owners get access to over 1.6 Billion dollars of business funding. We're on a mission to empower the small business owner by helping them tap into the smartest form of funding: Unsecured Business Credit – so that they can achieve their goals and dreams.

Contact

Information

"Fund&Grow was created to empower small business owners, but more importantly, to support entreprenuers in achieving their business and personal goals while they lead the way towards innovation." - Ari Page CEO of Fund&Grow

Ari Page and the Fund&Grow team help business owners obtain access to credit despite the ambiguous lending climate. Many people feel ripped off and scammed by the bank bailouts and wonder why they can't use the system to their advantage the way the big banks did. If you have good credit, the Fund&Grow program will get you the funds you need to grow your business.

Find 4,000+ 4.9-star average customer testimonials on the following platforms: SoTellUs, Trustpilot, Google, BBB, among others.

All credit is subject to lender approval based upon credit criteria. Up to $250,000 in business credit is for highly qualified clients over the term of the membership with multiple credit card batches and/or credit lines. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement. Fund&Grow is not a lender.

© 2025 Fund&Grow. All Rights Reserved.

Share

Share