** DRAFT - NOT PUBLICALLY VISIBLE **

National Consumer Credit Default Rates Reach New Lows in May 2015 According to the S&P/Experian Consumer Credit Default Indices

June 22, 2015

June 22, 2015

Four of the Five Cities Report Default Rate Decreases in May 2015

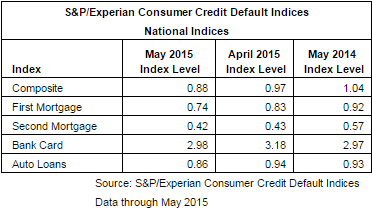

NEW YORK, June 16, 2015 /PRNewswire/ — Data through May 2015, released today by S&P Dow Jones Indices and Experian for the S&P/Experian Consumer Credit Default Indices, a comprehensive measure of changes in consumer credit defaults, continued its downward trend in default rates. Historical lows are reported for four of the five national indices. The composite index posted its second consecutive historical low of 0.88% in May, a decrease of nine basis points. The first mortgage default rate reported a historical low, down nine basis points to 0.74%. The second mortgage default rate also posted a second consecutive historical low of 0.42%, down one basis point from the previous month. The auto loan default rate reported a historical low of 0.86%, a decrease of eight basis points. The bank card default rate reported its first decrease since January 2015 with a rate of 2.98%, a decrease of 20 basis points, its largest reported decrease since October 2013.

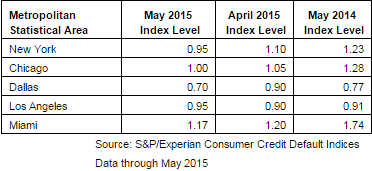

Four of the five major cities also continued their downward trend, reporting negative month-over-month default rate results in May. Dallas led the way, reporting a historical low of 0.70%, down 20 basis points from the previous month. New York posted its second consecutive decrease, reporting a historical low of 0.95%, a decrease of 15 basis points. Miami also reported its second consecutive decrease, down three basis points to a reported rate of 1.17%. Chicago reported its third consecutive decrease, posting a default rate of 1.00%, down five basis points from the previous month. Los Angeles reported the only rate increase, an increase of five basis points to 0.95%, its third consecutive monthly increase.

“Consumer credit default rates are below pre-crisis levels, at new lows and continue to drift down,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “These low levels should not come as a surprise: interest rates haven't turned up, consumer debt service as a proportion of household income is close to its record low, and the Federal Reserve reported that consumer wealth was at a peak in the first quarter of 2015. Nor should one assume that debt levels and defaults are low because no one is spending; on the contrary, May light vehicle sales were the highest since July 2005 and retail sales jumped. The economy looks good, consumers are spending and credit usage is rising. The combination of low debt service and economic expansion should ease worries about the fallout some fear when the Federal Reserve boosts interest rates.

“Two of the five cities – New York and Dallas – reported their lowest mortgage default rates since the series started in April 2004; the other three cities reported post-recession lows. During the housing collapse, Miami was one of the hardest hit cities in the country; Los Angeles also experienced a sharp rise in defaults and foreclosures. These figures are another indication that housing is recovering. Moreover, other data on financial difficulties confirm that foreclosures are declining and consumers’ capability and willingness to borrow are improving.”

The table below summarizes the May 2015 results for the S&P/Experian Credit Default Indices. These data are not seasonally adjusted and are not subject to revision.

The table below provides the S&P/Experian Consumer Default Composite Indices for the five MSAs:

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

have a question?

Our business experts are available to answer questions Monday - Friday from 9:00 a.m. - 6:00 p.m. EST

Call Us:

(800) 996-0270

Email Us:

service@fundandgrow.com

Watch our business credit webinar:

Obtain $250,000 Business Credit

Let's Stay Connected on Social Media!

For over 15 years, Fund&Grow has helped 30,000+ business owners get access to over 1.6 Billion dollars of business funding. We're on a mission to empower the small business owner by helping them tap into the smartest form of funding: Unsecured Business Credit – so that they can achieve their goals and dreams.

Contact

Information

"Fund&Grow was created to empower small business owners, but more importantly, to support entreprenuers in achieving their business and personal goals while they lead the way towards innovation." - Ari Page CEO of Fund&Grow

Ari Page and the Fund&Grow team help business owners obtain access to credit despite the ambiguous lending climate. Many people feel ripped off and scammed by the bank bailouts and wonder why they can't use the system to their advantage the way the big banks did. If you have good credit, the Fund&Grow program will get you the funds you need to grow your business.

Find 4,000+ 4.9-star average customer testimonials on the following platforms: SoTellUs, Trustpilot, Google, BBB, among others.

All credit is subject to lender approval based upon credit criteria. Up to $250,000 in business credit is for highly qualified clients over the term of the membership with multiple credit card batches and/or credit lines. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement. Fund&Grow is not a lender.

© 2025 Fund&Grow. All Rights Reserved.

Share

Share