In its advance estimate, the Labor Department announced that the U.S. Gross Domestic Product (GDP) increased at a 0.5% annual rate – the slowest since the first quarter of 2014. Economists had expected the economy to expand at a 0.7% pace after it displayed a 1.4% growth rate in the fourth quarter.

The main reasons behind the slowdown in economic growth were reduced levels of consumer spending and a strong dollar – which continued to undermine exports. In the first quarter of 2016, consumer spending (which constitutes more than two-thirds of U.S. economic activity), grew at just 1.9% – much lower than fourth quarter's 2.4% pace, and the least since the first quarter of 2015.

Low consumer spending, in turn, resulted in businesses placing fewer orders for goods. Although most organizations increased efforts to reduce an inventory bloat, inventory buildup nevertheless knocked off 0.33% point from first quarter GDP growth, compared to 0.22% in the fourth quarter.

Trade took away another 0.34% point from GDP growth, as an appreciating dollar led to reduced exports and increased imports. Between June 2014 and December 2015, the dollar gained 20% versus the currencies of the United States’ trading partners. The availability of cheap oil also hurt economic growth, with the result that business spending contracted at its fastest pace since the second quarter of 2009. Spending on non-residential structures declined at a 10.7% rate, while spending on mining exploration, wells and shafts tumbled at a record 86% pace.

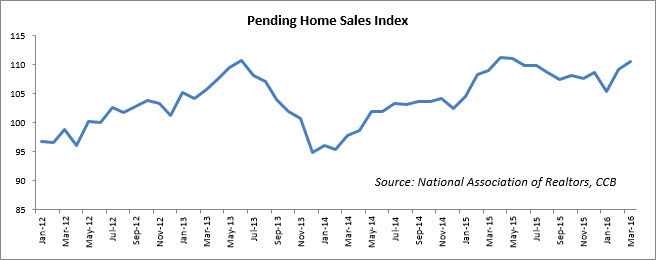

Overall, almost all sectors of the economy deteriorated in the first quarter, the only exception being the housing market. In fact, according to the National Association of Realtors, the Pending Home Sales Index, a forward looking indicator based on contract signings, increased by 1.4% in March to 110.5, and is now 1.4% above March 2015. Contracts rose 3.2% in the Northeast from the prior month and were up 3.0% in the South. They increased by 0.2% in the Midwest, but declined 1.8% in the West.

Lawrence Yun, NAR chief economist, explained that these numbers indicate a solid beginning to the spring buying season. "Despite supply deficiencies in plenty of areas, contract activity was fairly strong in a majority of markets in March," he said. "This spring's surprisingly low mortgage rates are easing some of the affordability pressures potential buyers are experiencing and are taking away some of the sting from home prices that are still rising too fast and above wage growth."

Apart from housing, the jobs market also seems to be fairly robust. Applications for unemployment benefits hovered near a 43-year low, and employment gains averaged 209,000 jobs per month in the first quarter.

Nevertheless, given the backdrop of a sluggish economy and reduced consumer spending, the Federal Open Market Committee (FOMC) opted not to raise interest rates last month. At the end of its two-day meeting, the Fed kept the range steady between 0.25% – 0.50%, while indicating that economic activity appears to have slowed. In a statement, it said, “Growth in household spending has moderated, although households’ real income has risen at a solid rate and consumer sentiment remains high.”

The Fed last hiked its target rate a quarter point in December, the first such move in more than nine years. At that time, FOMC members had signaled that four hikes were probable this year. However after last meeting, it seems that only two more hikes can be expected this year. This is not surprising, given that the Fed has so far failed to meet its target of 2% inflation, despite maintaining its rate target near zero for eight years. In its statement, the FOMC once again repeated that inflation is being held back by “the transitory effects of declines in energy and import prices,” but is expected to rise toward 2% over the medium term.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

have a question?

Our business experts are available to answer questions Monday - Friday from 9:00 a.m. - 6:00 p.m. EST

Call Us:

(800) 996-0270

Email Us:

service@fundandgrow.com

Watch our business credit webinar:

Obtain $250,000 Business Credit

Let's Stay Connected on Social Media!

For over 15 years, Fund&Grow has helped 30,000+ business owners get access to over 1.6 Billion dollars of business funding. We're on a mission to empower the small business owner by helping them tap into the smartest form of funding: Unsecured Business Credit – so that they can achieve their goals and dreams.

Contact

Information

"Fund&Grow was created to empower small business owners, but more importantly, to support entreprenuers in achieving their business and personal goals while they lead the way towards innovation." - Ari Page CEO of Fund&Grow

Ari Page and the Fund&Grow team help business owners obtain access to credit despite the ambiguous lending climate. Many people feel ripped off and scammed by the bank bailouts and wonder why they can't use the system to their advantage the way the big banks did. If you have good credit, the Fund&Grow program will get you the funds you need to grow your business.

Find 4,000+ 4.9-star average customer testimonials on the following platforms: SoTellUs, Trustpilot, Google, BBB, among others.

All credit is subject to lender approval based upon credit criteria. Up to $250,000 in business credit is for highly qualified clients over the term of the membership with multiple credit card batches and/or credit lines. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement. Fund&Grow is not a lender.

© 2024 Fund&Grow. All Rights Reserved.

Share

Share