** DRAFT - NOT PUBLICALLY VISIBLE **

The U.S. economy is getting a boost from stronger construction activity while manufacturers are struggling from a stronger dollar that hurts the export business. Tight labor markets continue to drive gains in the housing sector.

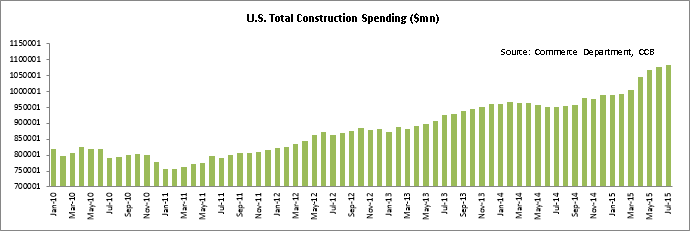

Outlays for residential and nonresidential projects were up for the eight straight months, and climbed 0.7% in July, the Commerce Department said on Tuesday. That put the seasonally adjusted annual rate at an estimated $1.08 trillion, the highest level since May 2008. It grew by a similar 0.7% in June.

An increase in the building of houses, factories and power plants led to a 13.9% jump in construction spending in the 12 months through July, the biggest year-over-year gain since March 2006. Spending on government building projects slipped slightly, although it has risen over the last year largely because of the construction and maintenance of highways and streets. Other reports also point to the strength in residential construction. Housing starts rose 0.2% in July to a seasonally adjusted annual rate of 1.21 million homes, the government said last week. All of July’s gains were driven by construction of single-family houses, which climbed 12.8% to the highest level since December 2007. In July, construction of single-family houses increased 2.1%, factories rose 4.7% and power plants grew 2.1%.

“We expect housing activity will continue to strengthen, underpinning greater residential investment in the coming quarters,” said Gregory Daco, head of United States macroeconomics at the forecasting firm Oxford Economics.

Meanwhile, U.S. home buyer demand remained steady in July, although consumers did not react significantly to easing mortgage rates. Contracts to buy previously owned U.S. homes rose less than expected in July, but continued to suggest upward momentum in the housing market recovery. The Pending Home Sales Index, based on contracts signed last month, as released by the National Association of Realtors, increased 0.5% to 110.9.

Pending home contracts become sales after a month or two, and last month’s increase suggested further gains in home resales, which reached an 8-1/2-year high in July. On a yearly basis, pending home sales increased for the 11th consecutive month and rose 7.4%, indicating the strengthening housing market. The July Index is the third highest reading of 2015. Contracts increased 4.0% in the Northeast and were unchanged in the Midwest. They rose 0.6% in the South, but fell 1.4% in the West.

Contract activity in most of the country held steady last month, which bodes well for existing sales to maintain their recent elevated pace to close out the summer,” said Lawrence Yun, chief economist for the NAR in a release. “While demand and sales continue to be stronger than earlier this year, realtors have reported since the spring that available listings in affordable price ranges remain elusive for some buyers trying to reach the market and are likely holding back sales from being more robust.”

Overall Economy Gets a Boost from Construction

Gains in construction, including the groundbreakings for houses, apartment complexes and commercial centers, have laid a foundation for broader economic growth. The government said last week that the economy expanded at an annual rate of 3.7% in the April-to-June quarter, after edging up just 0.6% in the first quarter.

“The U.S. economy continues to move forward. Manufacturing is slowing, but domestic demand remains strong,” said Joel Naroff, chief economist at Naroff Economic Advisors in Holland, Pennsylvania. “With families buying houses as well, we should see an upturn in the demand for manufacturing goods that go into building those products.” The economy grew at a 3.7% annual pace in the second quarter. The Gross Domestic Product growth estimates for the third quarter are currently above a 2.5% rate.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

have a question?

Our business experts are available to answer questions Monday - Friday from 9:00 a.m. - 6:00 p.m. EST

Call Us:

(800) 996-0270

Email Us:

service@fundandgrow.com

Watch our business credit webinar:

Obtain $250,000 Business Credit

Let's Stay Connected on Social Media!

For over 15 years, Fund&Grow has helped 30,000+ business owners get access to over 1.6 Billion dollars of business funding. We're on a mission to empower the small business owner by helping them tap into the smartest form of funding: Unsecured Business Credit – so that they can achieve their goals and dreams.

Contact

Information

"Fund&Grow was created to empower small business owners, but more importantly, to support entreprenuers in achieving their business and personal goals while they lead the way towards innovation." - Ari Page CEO of Fund&Grow

Ari Page and the Fund&Grow team help business owners obtain access to credit despite the ambiguous lending climate. Many people feel ripped off and scammed by the bank bailouts and wonder why they can't use the system to their advantage the way the big banks did. If you have good credit, the Fund&Grow program will get you the funds you need to grow your business.

Find 4,000+ 4.9-star average customer testimonials on the following platforms: SoTellUs, Trustpilot, Google, BBB, among others.

All credit is subject to lender approval based upon credit criteria. Up to $250,000 in business credit is for highly qualified clients over the term of the membership with multiple credit card batches and/or credit lines. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement. Fund&Grow is not a lender.

© 2025 Fund&Grow. All Rights Reserved.

Share

Share